Online Purchases of Auto Parts by Mexicans Reach 3,319 Pesos per Person, Amounting to a 17% Increase Compared to Last Year (Based on Surveys)

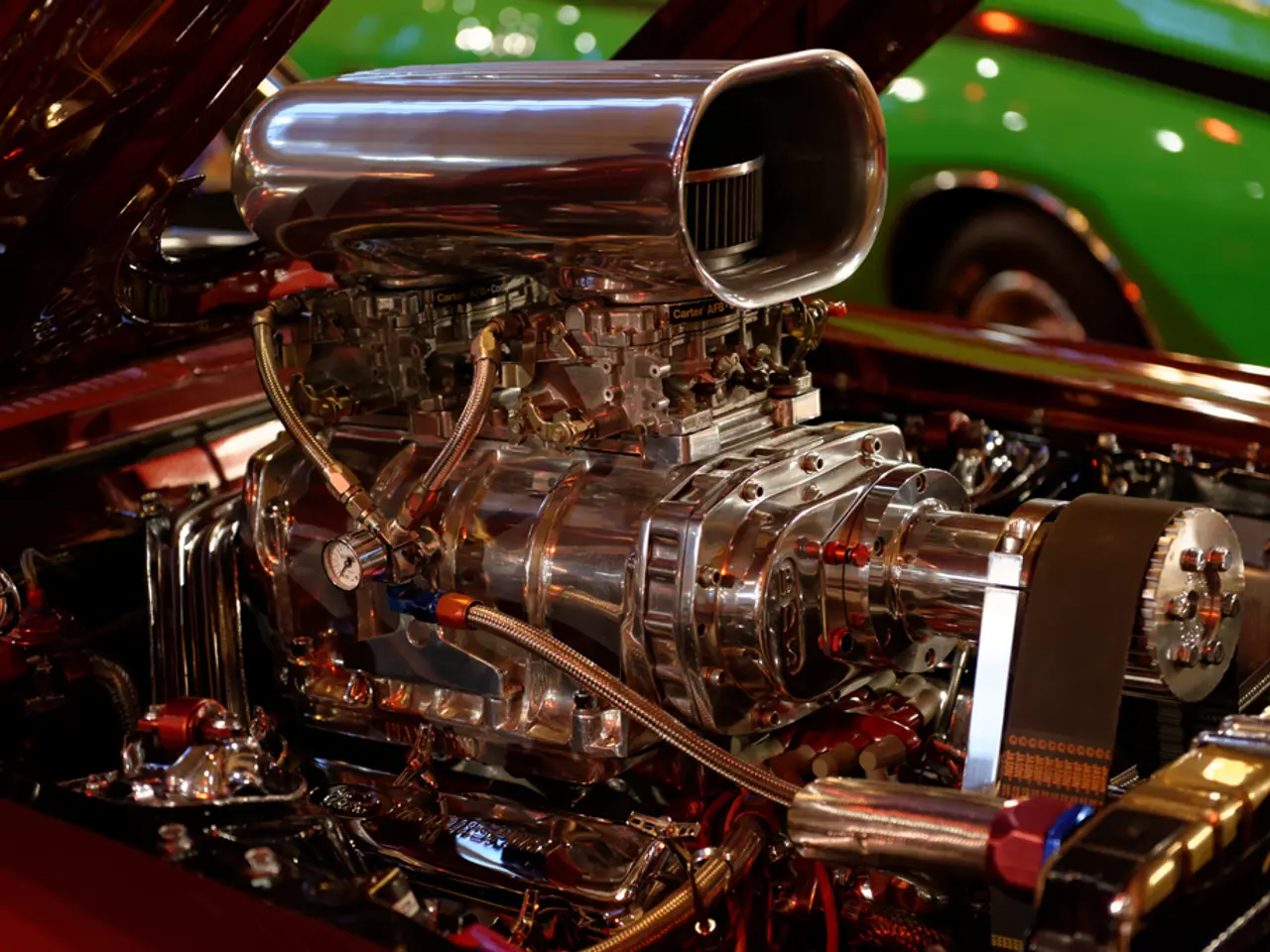

Mexico's auto parts market is experiencing significant growth, particularly in the online sector. This trend is driven by a variety of factors, including rising vehicle use, expanding vehicle sales, and increasing demand for repair and maintenance parts.

Growth in Motorcycle Use and the DIY Culture

In Mexico City alone, the number of motorcycles has seen a 3.4 times increase over the past decade, amounting to 716,400 motorcycles in 2024[1]. This growth has also fostered a DIY culture, with many motorcyclists taking on repairs and maintenance tasks themselves.

Shifts in Purchasing Habits

This growth in motorcycle use is reflected in changing purchasing habits. On eBay, for instance, there has been a rapid transformation in the buying of auto parts, especially in technical categories like motorcycle parts[2].

Growing Demand for Motorcycle Parts

In the case of motorcycles, headlights and taillights, batteries, seats, tires, and disc brakes are the most commonly bought used parts[1]. Motorcyclists spent 3,504 pesos on auto parts in April and May 2025, representing a 17% increase from the same period in the previous year[3].

The Global Landscape

Mexico is a key market in Latin America, with high demand for auto parts. After a pandemic-related low in 2020, China’s exports of vehicles and parts to Mexico grew sharply, with a 44.6% year-on-year increase in 2022 and nearly doubling since 2018[1]. The overall motor vehicle parts market globally is expanding rapidly, forecasted to grow at 6.6% CAGR through 2029 to $3.7 trillion[2].

The Motorcycle Sector

The motorcycle sector in Latin America, though Mexico-specific data is less detailed, is growing alongside regional markets such as Brazil and Argentina. The global motorcycle tire market, a key segment of motorcycle parts, was valued at $4.85 billion in 2024 and is projected to grow at an 8% CAGR through 2032, driven by increasing adoption of electric motorcycles and demand for premium tires[5].

The Online Sales Channel

The online sales channel for auto and motorcycle parts is expanding as digitalization progresses, enabling easier access to parts, especially aftermarket and repair components. Latin America’s strong aftermarket demand and Mexico’s position as a large recipient of Chinese auto parts highlight e-commerce potential in the region[1][2].

Trust and Convenience

Trust-building is important to consumers in the digitalization of the auto parts sector, with this factor growing 10 points in relevance in the last year. Meanwhile, 85% of auto parts buyers cite convenience as the main reason for preferring the online channel, an 11-point increase from 2024[4].

The Future of the Online Auto Parts Market

The online auto parts market represents 25% of the total auto parts market in Mexico, and the online market for used auto parts shows high growth potential[4]. Among car drivers, the trend of self-servicing their vehicles is lower at 41%, compared to 60% among motorcyclists[4]. As motorcycles become a key driver of growth within online auto parts sales, we can expect to see this trend continue.

Sources:

- Statista

- Grand View Research

- eBay Mexico

- BBVA Research

- MarketsandMarkets

- The increasing demand for motorcycle parts in Mexico, driven by factors such as growth in motorcycle use and the DIY culture, has led to a transformation in the buying of auto parts on platforms like eBay, particularly in technical categories like motorcycle parts.

- As the online sales channel for auto and motorcycle parts expands in Mexico, driven by digitalization and convenience, the market for used motorcycle parts is expected to show high growth potential, given the trend of self-servicing among motorcyclists.