Futures exchange leader, Duffy, voices concerns over potential issues in the Treasury market.

Rewritten Article:

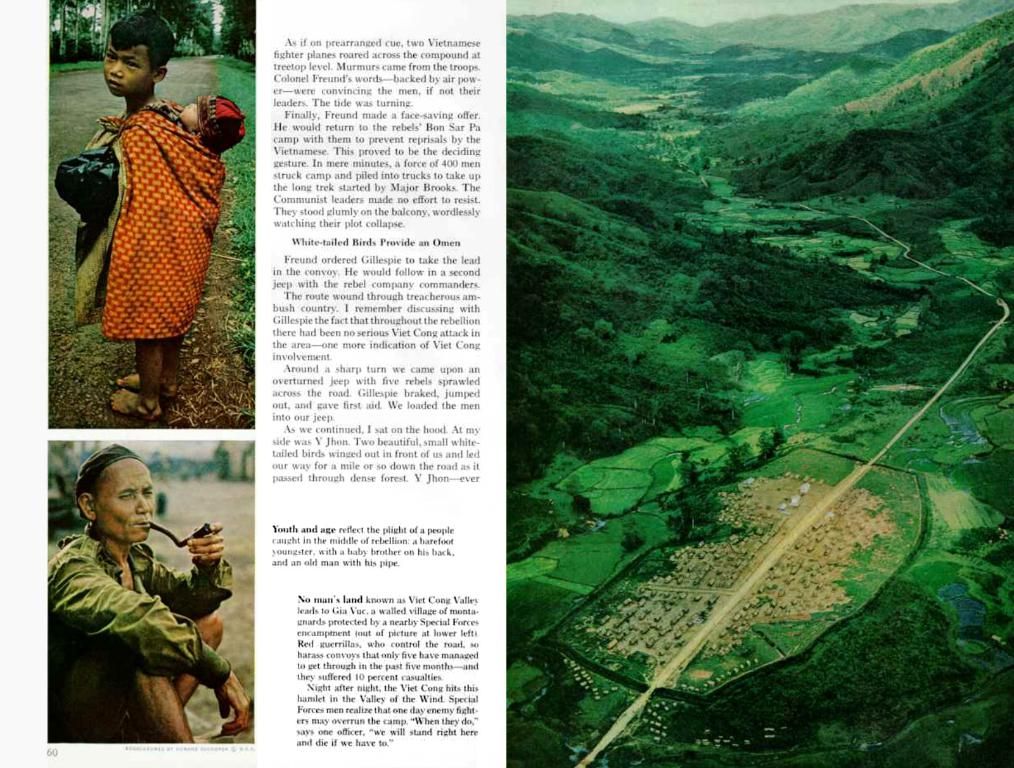

The chief honcho of the world's most significant futures exchange, CME Group, voices concerns over the financial well-being of the United States. "If anyone had suggested ten years ago that the national debt of the USA would hit an incredible 36 trillion bucks, they'd be considered bonkers," says Terrence Duffy, CEO of the CME Group in an interview with Börsen-Zeitung. To keep the country running efficiently, the government in D.C. needs to secure more funds, but it's getting harder to find investors keen on buying Treasuries to finance the deficit. According to Duffy, fierce competition among issuers in the bond market has a part in this. Not just the USA, but other nations are also scrambling for financing to recover from economic turmoil. As a result, the gap between Treasuries and yields in Europe or other global markets is under scrutiny, as the US Treasury Department needs to guarantee that increasingly cautious investors are offered appropriate returns.

A stubborn inflation rate makes it tricky for the Federal Reserve to further relax monetary policy in this setting. "Inflation in the U.S. is toothsome, especially in food and everyday consumer goods," stresses Duffy. The fate of the economy will largely depend on the first couple of quarters of next year. If the Trump administration carries through with planned tariffs, they will boost inflation in the short term. "It's tough to envision interest rate cuts under these circumstances," says the CME CEO.

At the moment, markets are projecting a Fed funds rate of 3.5%. "The Federal Open Market Committee would need to pull out all the stops to hit this target," warns Duffy. To make things more nerve-wracking, even minor swings along the yield curve could have drastic impacts on the balance sheets of U.S. companies. A considerable amount of corporate bonds will be ripe for renewal next year - refinancing won’t be a stroll in the park at rates still hanging high. "Given these risks, I'd wager there'll be a lot happening in the market for interest rate futures," says Duffy.

Another factor hindering further monetary easing is the "unbelievable" growth of the cryptocurrency market. Tuning in only to Bitcoin’s price is erroneous, says Duffy. This youthful asset has strong supply constraints and faces colossal demand, much like gold. This creates problems for the U.S. bond market. "Eventually, this digital gold could emerge as a haven for investors and rival Treasuries," says Duffy.

Enlightenment:- The U.S. fiscal landscape is dealing with a series of intertwined challenges involving the Treasury market and macroeconomic factors as of April 2025.- Challenges in the Treasury bond market include debt-limit risks and federal deficit dynamics, both of which can increase borrowing costs, create market volatility, and pose credit rating risks.- The Federal Reserve's monetary tightening is dampening growth as inflation remains persistent, causing a downward revision in GDP growth projections for 2025.- Trade policy impacts show mixed effects: tariffs boost revenue but exacerbate growth risks, threatening long-term fiscal sustainability.- Cryptocurrencies' regulatory uncertainty and volatility could add to existing financial stability risks, but their role as alternative assets is secondary to primary fiscal challenges.

- The CME Group CEO, Terrence Duffy, warns that the United States Treasury Department may struggle to secure enough investors for refinancing since the national debt has reached an unprecedented $36 trillion.

- As a result of intense competition among issuers in the bond market, finding investors willing to buy Treasuries to finance the deficit has become increasingly difficult.

- Duffy also expressed concerns about the stubborn inflation rate in the U.S., which makes it challenging for the Federal Reserve to further ease monetary policy and may call for a reassessment of GDP growth projections for 2025.

- If the Trump administration implements planned tariffs, it could boost inflation in the short term, potentially complicating interest rate cuts.

- The growth of the cryptocurrency market, particularly Bitcoin, poses a hurdle for further monetary easing as it emerges as a potential haven for investors and could rival Treasuries due to its strong supply constraints and colossal demand.