Struggling Sales and Profits: German Car Manufacturers Lag Behind Asian Rivals

Auto manufacturers from Germany face lagging performance compared to competitors worldwide.

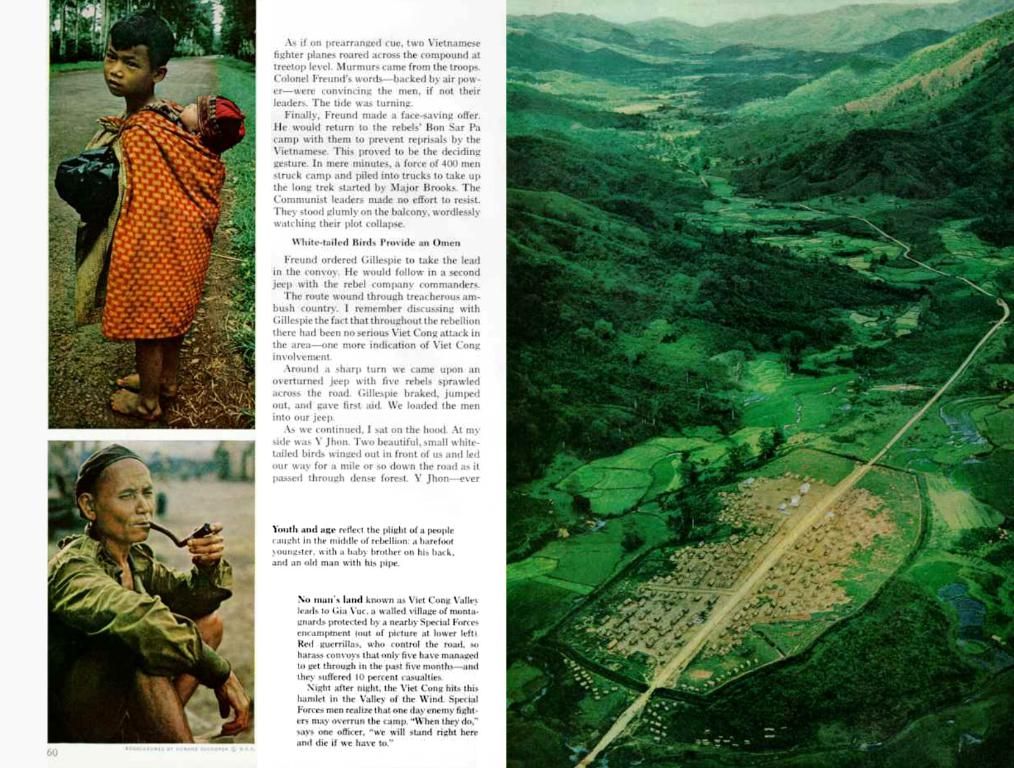

In the cutthroat world of automobile production, German carmakers are finding themselves losing ground to their Asian competitors, according to a recent analysis by EY. While German companies saw a decline in sales and profits in Q1 of this year, Asian competitors - particularly new entrants from China - made significant gains.

The combined sales of the three German carmakers dropped by 2.3%. Only Volkswagen managed a slight increase, while BMW and Mercedes saw significant declines. Profit also fell by nearly a third for all three combined. US manufacturers fared similarly with a 2.9% drop in sales and almost a third in profit.

On the flip side, the story was much brighter in Asia, especially China. Manufacturers from the People's Republic saw a 14.7% increase in sales and a 66% increase in profit. BYD and Volvo's parent company Geely led the way. Japanese and South Korean manufacturers also outperformed their European and American counterparts. In fact, five of the six most profitable car manufacturers in the world were from Asia, with BMW making it to third place with a 9.3% profit margin.

Existential Crisis Ahead?

EY market observer Constantin Gall warns of an existential crisis for some manufacturers, with the crisis expected to intensify throughout the year. The automotive industry is currently grappling with challenges from all fronts, with some established players' business models at risk. If profits continue to erode, some manufacturers may have to question their very existence, as competition in the industry is fierce.

Troubles Aplenty for Established Manufacturers

Established car manufacturers, led by the Germans, are currently facing multiple issues: weak economic growth is slowing demand, high costs, and the slow rollout of electric mobility are putting pressure on results. To make matters worse, the Chinese market is increasingly being dominated by local players, displacing the Western market leaders.

The situation is further exacerbated by the 25% tariffs imposed by US President Donald Trump on car imports since April. In the worst-case scenario, these tariffs could result in billions of dollars in losses for both European and US manufacturers, further driving down their profit margins. The gap to Chinese manufacturers, who are not represented in the US, will widen.

Cost-Cutting Won't Be Enough

Manufacturers, such as Volkswagen, have already announced cost-cutting programs with job cuts in recent months. However, cost-cutting alone may not be sufficient. Western car manufacturers must completely reinvent themselves, embracing comprehensive digitization, faster vehicle development, and faster decision-making. They can also learn from the new challengers from the East, who have demonstrated success with a combination of speed, flexibility, and a focus on investments.

Although VW can claim a minor success in Q1, outpacing Toyota in terms of revenue, the Japanese company still led in sales and operating profit. German manufacturers must, therefore, strive to close the gap with their Asian competitors to secure their future in the global automotive market.

The German car manufacturers are facing an existential crisis due to their declining sales and profits compared to Asian competitors, who have seen significant gains, particularly from Chinese manufacturers. To secure their future in the global market, these manufacturers need to completely reinvent themselves, embracing comprehensive digitization, faster vehicle development, and faster decision-making, as well as learning from the success of Eastern challengers in terms of speed, flexibility, and targeted investments – such as vocational training programs to remain competitive and improve their technological capabilities.